This post consists of general information and is not meant to offer information that specifies to American Express product or services. Comparable services and products supplied by various firms will certainly have different functions and you must always check out item details before acquiring any economic item.

The promissory note can be a valuable device when it involves borrowing and loaning as it aids to maintain all events abreast. Find out just how a cosigned promissory note jobs.

At-A-Glance

- A promissory note is a created statement by one celebration agreeing to pay an additional party an amount of money.

- These notes consist of terms pertaining to the financial obligation, including the principal amount, rates of interest, and payment timetable.

- Promissory notes can be made use of in a number of different circumstances where money is being lent.

Whether you’re getting a personal finance or a home loan, recognizing how promissory notes job is vital for both borrowers and lending institutions. This article dives into the numerous kinds of promissory notes and the role they play in aiding to formalize a financial debt responsibility.More Here fillable iowa promise to pay pdf At our site

What Is a Promissory Note?

Fundamentally, a promissory note is a composed paper that contains a promise by one celebration (the maker or issuer) to pay one more event (the payee) a certain sum of cash, either on demand or at a fixed time in the future.

These notes commonly consist of the terms involved with the financial debt, including the major quantity of the lending, the interest rate, and the payment schedule.

Promissory notes can be utilized in a variety of different circumstances when one celebration is lending funds to another. For example, you might be asked to authorize one when obtaining a home mortgage or a personal lending. A cosigned promissory note can likewise be used when lending funds to a family member.

Types of Promissory Notes

There are several usual kinds of promissory notes. Here’s a look at a couple of usual situations when a cosigned promissory note may be used:

- Trainee Lending Promissory Notes

Students may be required to authorize cosigned promissory notes when obtaining a trainee lending. When securing government pupil car loans, a pupil may be permitted to sign a single promissory note referred to as a master cosigned promissory note.1 - Home Mortgage Promissory Notes

You might be asked to sign a home loan cosigned promissory note when obtaining a home mortgage. Commonly this will certainly include the financing’s rates of interest, settlement dates, settlement length of time, and extra.2 - Personal Financing Promissory Notes

When loaning cash to buddies or household, a cosigned promissory note might be utilized. This can assist to prevent disagreements about the terms of the financing later on.3

Protected vs. Unsecured Promissory Notes

Promissory notes might also be secured or unsecured, depending upon the scenario.

- Protected Promissory Notes

These are backed by security. If the customer defaults, the loan provider might have the right to retrieve the property. This kind of note prevails in mortgage financing.4 - Unsecured Promissory Notes

Unlike secured notes, unsafe promissory notes do not have collateral backing them.5

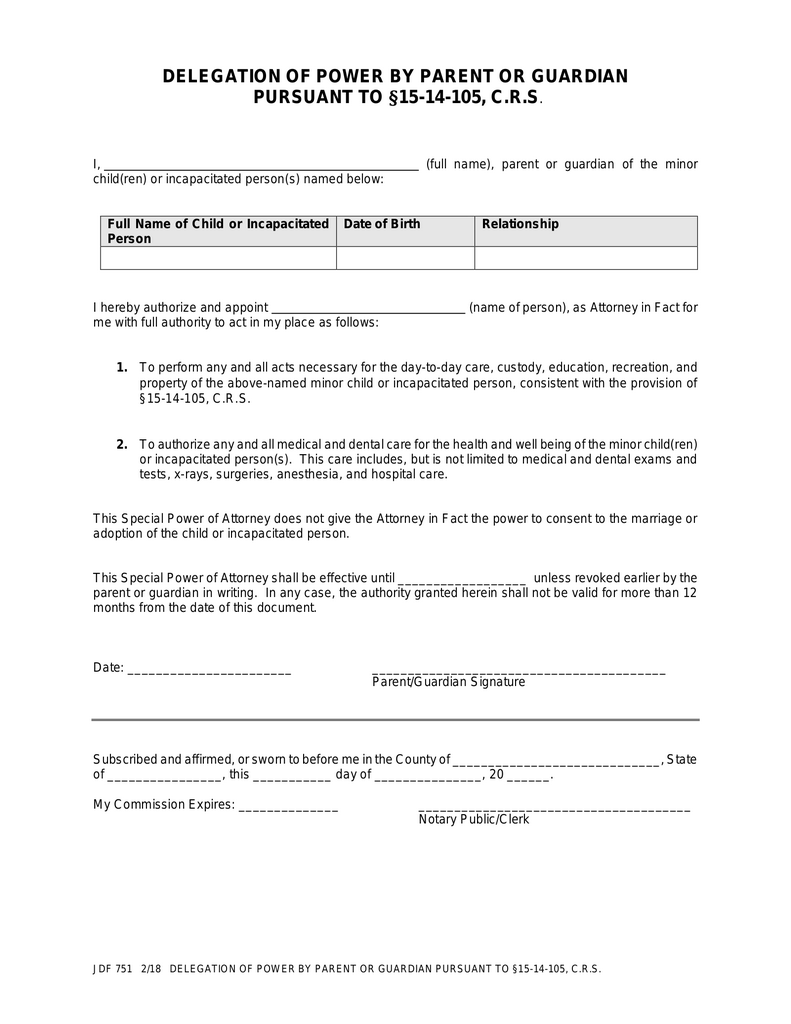

What’s Consisted of in a Promissory Note?

A promissory note generally consists of the complying with elements:6

- The name and address of the customer and lender

- The maturation date

- The quantity borrowed

- The repayment schedule

- The rates of interest

- Early repayments process

- Interest billed for past due repayments

- Default

- Waivers, modifications, and regulating regulations

A home loan cosigned promissory note might include:7

- The amount you owe

- The interest rate

- How passion can transform if you have an Adjustable Rate Home Loan (ARM)

- Payment dates

- Settlement quantity of time

- Where to send out payments

- Repercussions of not making monthly settlements

It is essential to assess and understand each part of the note prior to finalizing. If you’re uncertain regarding any type of terms or conditions, seeking legal advice can help clarify your commitments and protect your rate of interests.

Promissory Note Repayment

Promissory notes may be structured in different ways when it comes to repayments as well. Here’s a consider several of the different ways that a promissory note might be structured:

- Installations

With installation repayments, the borrower is required to make regular repayments with rate of interest over a set period. They are foreseeable and commonly used for vehicle lendings or individual finances with a fixed repayment routine.8 - Balloon Installments

Balloon payments might be made use of in home loan. With a balloon payment cosigned promissory note, the customer usually pays a reduced rate of interest for a period of time, acquire just pays back a fraction of the principal equilibrium. At the end of the loan term, the customer might decide to reset the car loan or repay the remaining equilibrium.9 - Due On a Particular Date (DOSD)

DOSD cosigned promissory notes are straightforward and need the payment of a lending by a particular date. These notes can be made use of when lending small amounts of money to a friend or member of the family.10 - Due On Demand

With this sort of note, there is no concrete payment day specified, and borrowers can repay the car loan when they are monetarily able to do so. The loan provider may also have the ability to demand repayment any time. This flexibility likewise makes them a choice to consider when providing funds to loved ones.11

The Takeaway

A cosigned promissory note is a written promise by one party to pay another. They are typically used when offering or obtaining cash and can help to maintain all events on the exact same page and familiar with their responsibilities.